When you’re an independent contractor or freelance consultant there’s a strong relationship between the clerical aspects of project work and the pay you earn. Attentive notes and accurate invoices not only play a crucial role in bringing home your deserved compensation but also help to win repeat business and generate a positive reputation for prospective clients. To help you get the most out of the work you deliver, we’ve put together 7 tips for effective recordkeeping and invoicing.

A good invoicing process will turn headaches into paychecks.

1. Keep your own invoicing system.

Before starting a project, you need your own organized method for tracking your time. Services like QuickBooks and FreshBooks work well, as do more basic tools, like spreadsheets. Regardless, we recommend that you keep track digitally. Digital records ensure your hours are archived and organized, while leaving valuable information easily accessible and documented (should the need for corroboration arise).

Once you’ve established a method for tracking time, set aside 20 minutes each week to review, update, and back up your books and data. Additionally, archived project work includes email exchanges with your client, so build a habit of hanging onto those as well.

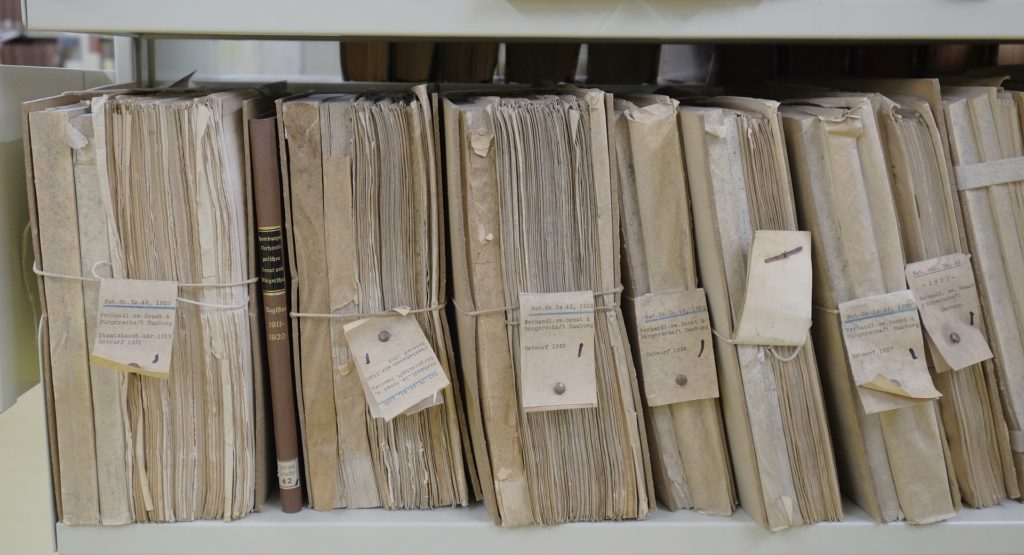

Even in our digital age, hard copies continue to exist (e.g. receipts for travel-related expenses). With this in mind, you’ll also need a reliable physical filing system to precisely and securely store vital information relevant to the engagement that exists in print.

2. Start the process right.

Communication is one of the most important aspects of client relationships. Practice active dialogue with your client throughout the entire engagement. Start by determining and communicating project scope at the outset—a step that will help you invoice accurately down the line. Then, once work has started, immediately communicate to your client any adjustments to your original estimates (more or less time), especially if these shifts will impact your deadlines or deliverables. In the unfortunate instance of a future dispute, you’ll be able to use your records of project work and client communication to remind your client what you previously agreed upon.

3.When in doubt, keep it.

Once work has begun, use your system to maintain and organize all documentation related to the project. Physically and digitally, these documents include:

- income earned

- wages paid

- expenses associated with expert work

- invoices

- accounting records

- transaction records

- tax filings (annually, quarterly and monthly, as applicable)

- bank and credit card statements

- contracts with clients and partners

- purchase orders

- licenses

- permits

- meeting notes

- loans

- proofs of purchase

- health and safety documentation

- inventory logs

Maintaining a careful, accurate ‘paper trail’ will keep you prepared for two possible scenarios: (i) the IRS disputes the amount you say you earned, and (ii) you’re engaged in an audit-related lawsuit. Bear in mind that the form of a document—physical vs. digital—will depend on your client’s system. Be prepared to archive and organize essential files accordingly.

4. Keep files for a long time.

Experts like you undertake a wide variety of critical engagements. You’ll want to keep logs of all your expert engagements to avoid, and easily clear, potential conflicts. Keeping a list of every project including, for litigation cases, who won, will help you easily address potential questions and support your response.

A good filing system will help you stay organized and quickly find the documents you need.

Client records can also serve as an internal ‘memo system,’ helping to indicate, among other details, which clients are more difficult to deal with. Keeping and organizing business cards and project records will help with this effort.

5. Communicate your work clearly in the invoice.

Refrain from practices that obscure how you’ve been spending your time. One of these is block invoicing (or bill blocking)—listing hours worked without indicating your specific activity. If you’re debating whether your invoiced hours are too vague, or might be doubted, ask yourself:

‘Will the client understand what I am billing for and the value it has provided to them?’

Address this question clearly in your invoice and be sure to include the date and length of time spent. These line items are essential in helping your client understand what s/he has paid for. If you have different billing fees for different activities, keep track of those activities separately.

In addition to block invoicing, avoid double dipping into travel time as work time for the same client. If you bill a client for travel, you should not bill the same client for working during that time. Carefully tracking your hours worked means investing your valuable time in traveling or working for one client.

6. Exercise your best time management practices.

Invoice on time. If your client doesn’t have the invoice, you can’t get paid. Send invoices in a timely manner. An invoice sent months after the work takes place is likely to cause confusion, especially if the customer doesn’t recall the transaction exactly. Such invoices are more likely to be challenged and less likely to get paid.

7. Relay expectations and intentions in advance.

We realize your schedule might force you to undertake a great deal of work in a short amount of time—managing multiple projects from multiple clients. Due to your highly specialized work and busy schedule, to meet deadlines you might be forced to compress three days’ normal work into two days’ excessive work. Unfortunately, too many hours per day can trigger a red flag with clients, leading them to believe they’re being over-billed. This is why it’s best to communicate to the client ahead of time that, for deadline reasons, you’ll be conducting certain work in a condensed amount of time. Then you can work together with your client to avoid surprises on their end.

In the same way a large number of listed hours can prompt skepticism from clients, it can also invite auditing down the line. Forestall this problem by providing time or cost estimates to your clients before beginning work. Not only will providing time and cost estimates help with potential auditing, but it will also let your client manage their budgets and workload expectations. Even if estimating is difficult, provide an approximate range or ‘likely not to exceed’ amount. You never want to enter a project estimating 90 hours of work, while your client is thinking it will take you just 30.

Finally, don’t think of recordkeeping as a task. Instead, approach recordkeeping as a habit. This way recordkeeping will become an essential aspect of project work, client relationships, and making sure you get paid.

Let’s get to it!